Introduction: Why This Comparison Matters

Provider Billing vs Outsourcing in 2025 is one of the most important financial decisions healthcare practices will face. Many providers believe that doing their own billing saves money and keeps them in control. In reality, in-house billing often leads to denied claims, low reimbursements, compliance risks, and — worst of all — hidden revenue loss that goes unnoticed.

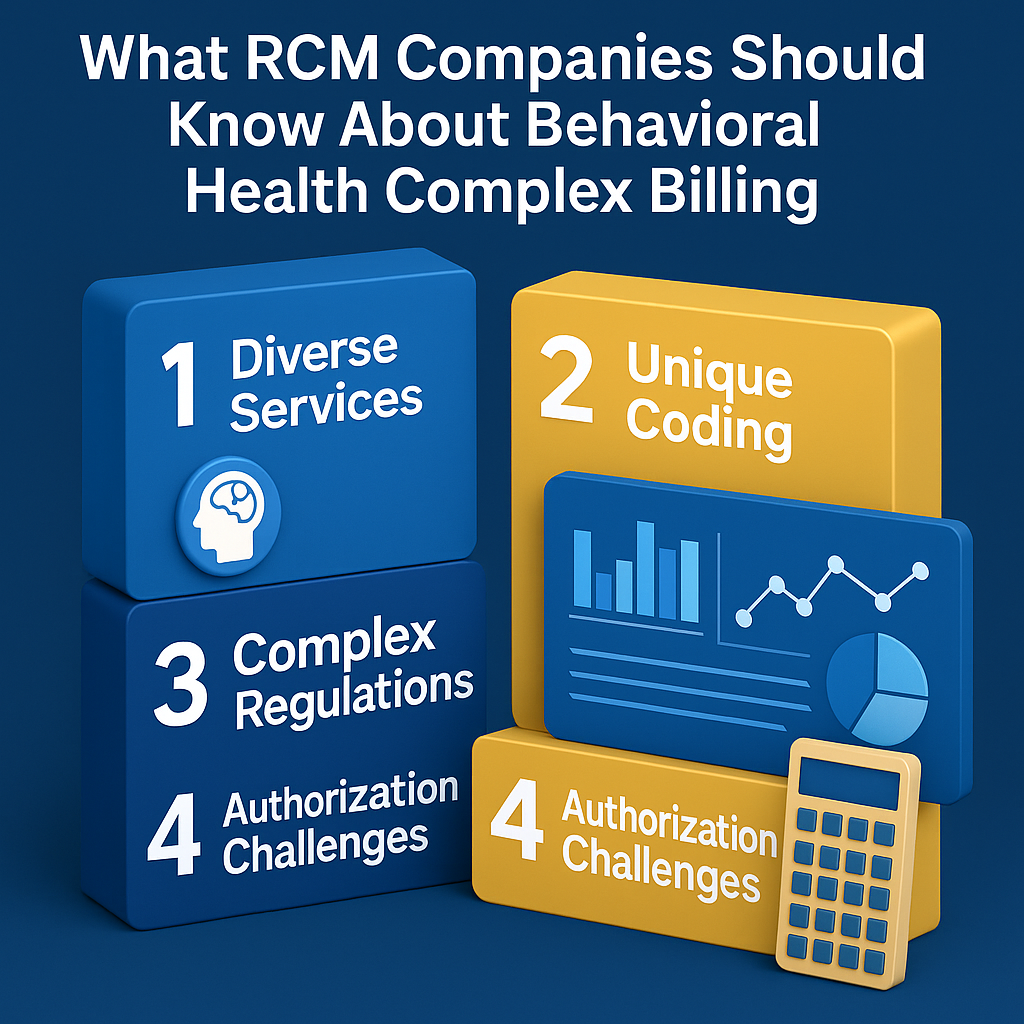

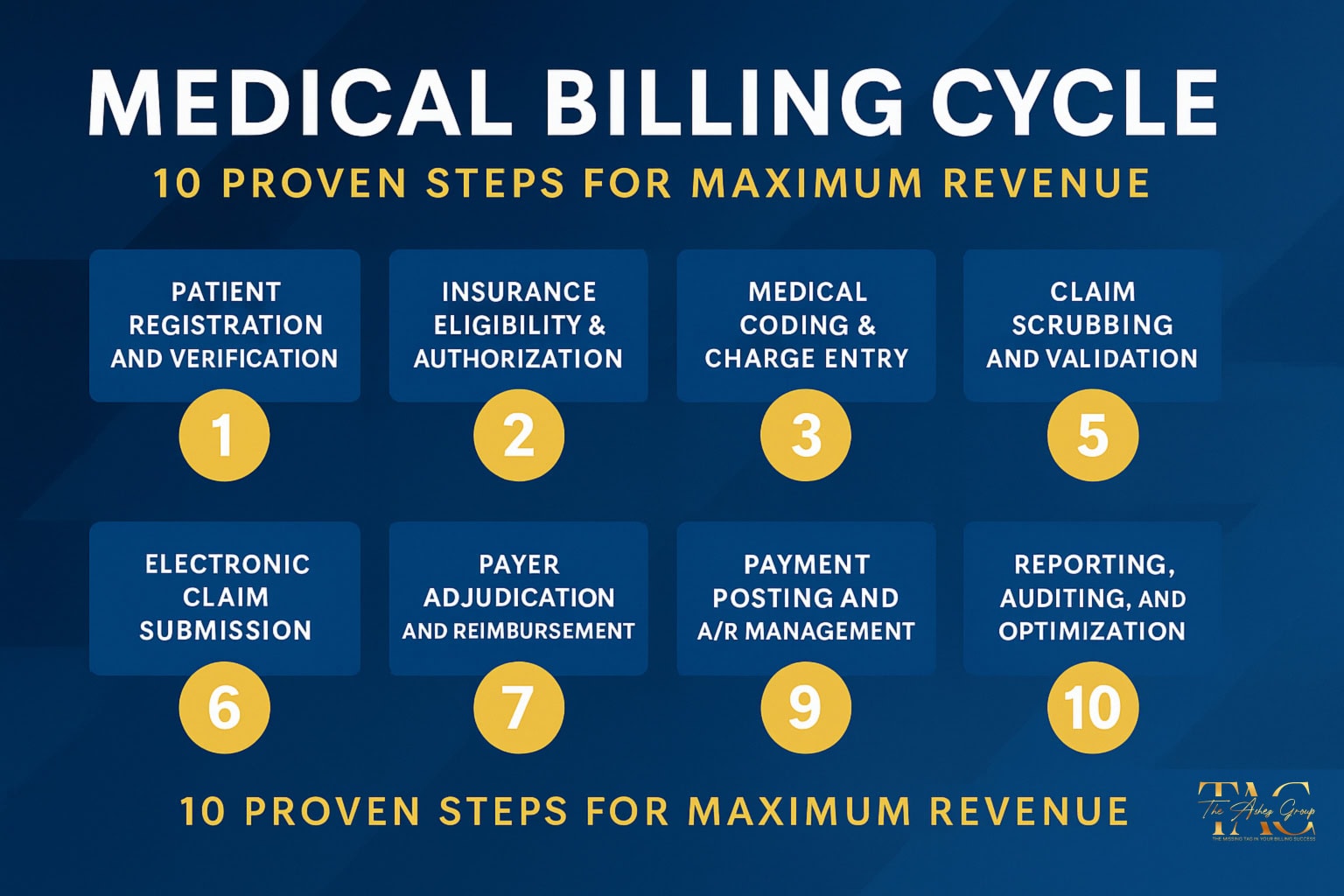

The difference between provider billing and outsourcing comes down to expertise. In-house teams may focus only on data entry, while true outsourced medical billing services handle coding accuracy, modifier usage, payer compliance, denial management, and revenue cycle optimization.

This guide reveals the hidden costs of provider billing vs outsourcing in 2025, with real-world examples of denied claims, underpayments, and lost revenue — plus how outsourcing ensures providers collect every dollar they deserve.

Provider Billing vs Outsourcing in 2025 — The Risks of Doing It Yourself

Lost Time on Billing Instead of Patient Care

Every hour spent correcting claims or chasing payers is an hour not spent with patients. Provider productivity and patient care drop when billing is managed in-house.

Higher Claim Denial Rates Without Expert Oversight

In-house billing staff may only perform data entry, not true medical billing. Missing modifiers, wrong codes, and payer-specific errors lead to denials that go unappealed — meaning lost revenue.

Compliance Risks and Audit Exposure

Billing is more than typing codes. Providers face compliance requirements from CMS, HIPAA, and private payers. Incorrect claims can trigger audits, penalties, and recoupments.

Hidden Costs of Staffing and Turnover

Hiring and training in-house billers is expensive. If a biller quits or makes repeated errors, cash flow and collections suffer immediately.

Provider Billing vs Outsourcing in 2025 — Real Claim Denial Examples

When comparing Provider Billing vs Outsourcing, denial management is one of the most overlooked benefits of outsourcing.”

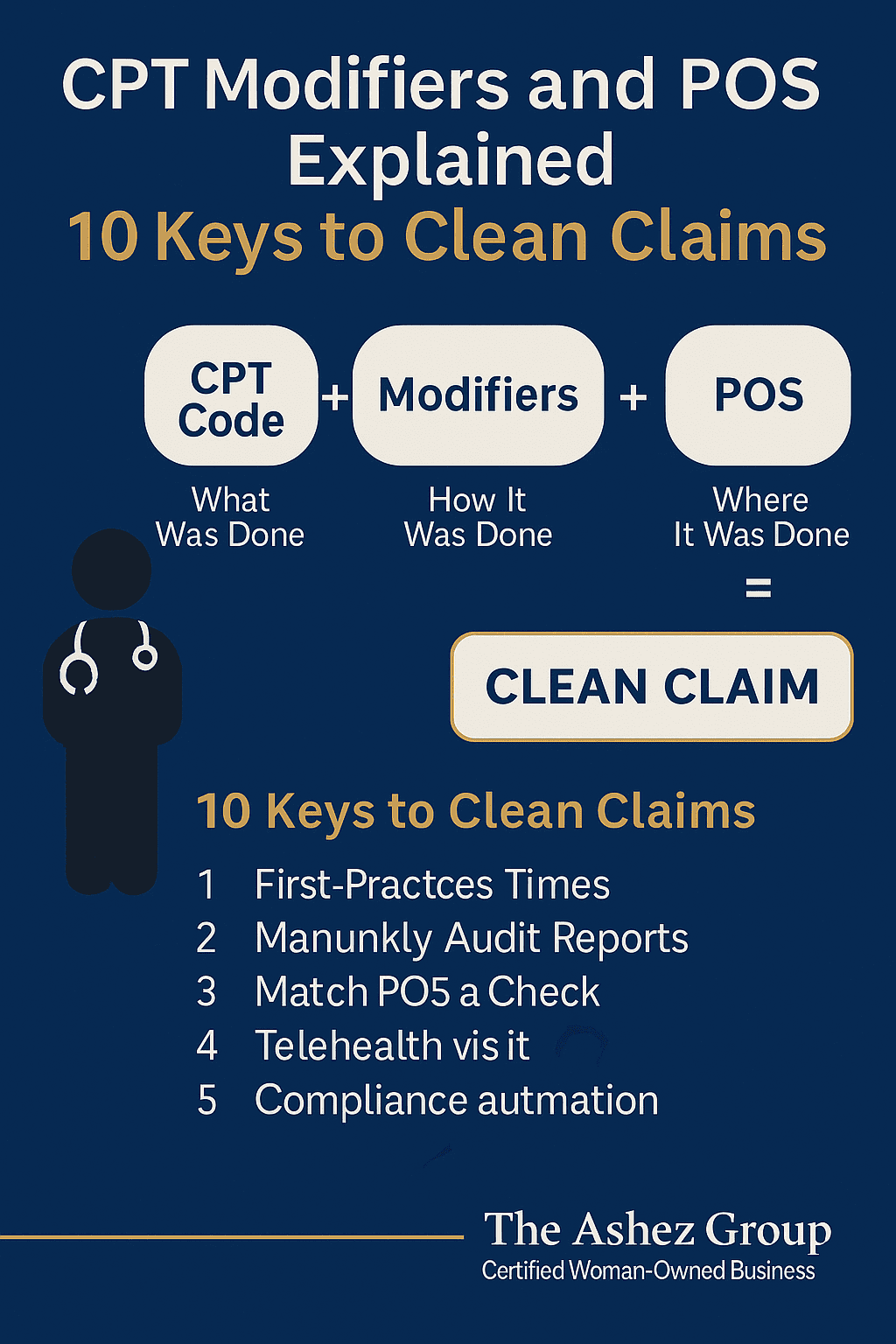

Missing Modifier 25 Leads to Denied E/M Claims

- Scenario: Provider performs psychotherapy (90833) + E/M visit (99213) on the same day.

- In-house billing: Submitted without Modifier 25.

- Result: Insurer denies 99213 as “not separately billable.”

- Revenue Lost: $80–$120 per visit → up to $5,000 annually.

Outsourced Fix: Submit 99213 + 25 with 90833 → both services reimbursed.

According to CMS Claim Denials, thousands of claims are rejected every year due to missing or incorrect modifiers.

Telehealth Billing Errors with Modifiers 95 and GT

- Scenario: Provider delivers 60-min psychotherapy (90837) via telehealth.

- In-house billing: Staff uses GT instead of 95 with POS 02.

- Result: Claim denied as “invalid modifier.”

- Revenue Lost: $150 per session; 5 denials = $750 lost.

Outsourced Fix: Submit 90837 + 95, POS 02 → claim approved.

Incorrect Use of Modifier 59 vs 76/77

- Scenario: Provider performs a health behavior assessment (96156) and psychotherapy (90837).

- In-house billing: Staff adds Modifier 59 to psychotherapy incorrectly.

- Result: Claim denied for “unbundled incorrectly.”

- Revenue Lost: $150+ per encounter.

Outsourced Fix: Apply 59 only when services are distinct or use 76/77 for repeats. Both claims get paid.

Low Reimbursement in 2025 — The Silent Revenue Loss Providers Miss

Under-Coding Therapy Sessions Without Modifier 25

- Scenario: Provider performs 60-min psychotherapy (90837, $150) + E/M medication check (99213, $120).

- In-house billing: Only 90834 (45-min therapy, $100) submitted, skipping Modifier 25.

- Result: Claim paid at a lower rate. Provider receives $100 instead of $270.

- Revenue Lost: $170 per patient → over $10,000 per year.

Outsourced Fix: Submit 90837 + 99213 + Modifier 25 → full reimbursement collected.

(See AMA CPT Code Set)

Accepting Lower Payouts Because Claims “Got Paid”

Providers often assume that if claims get paid, billing is correct. But many reimbursements are below contracted rates due to incorrect coding or missing modifiers. Outsourcing prevents these silent revenue leaks by double-checking every claim for accuracy.

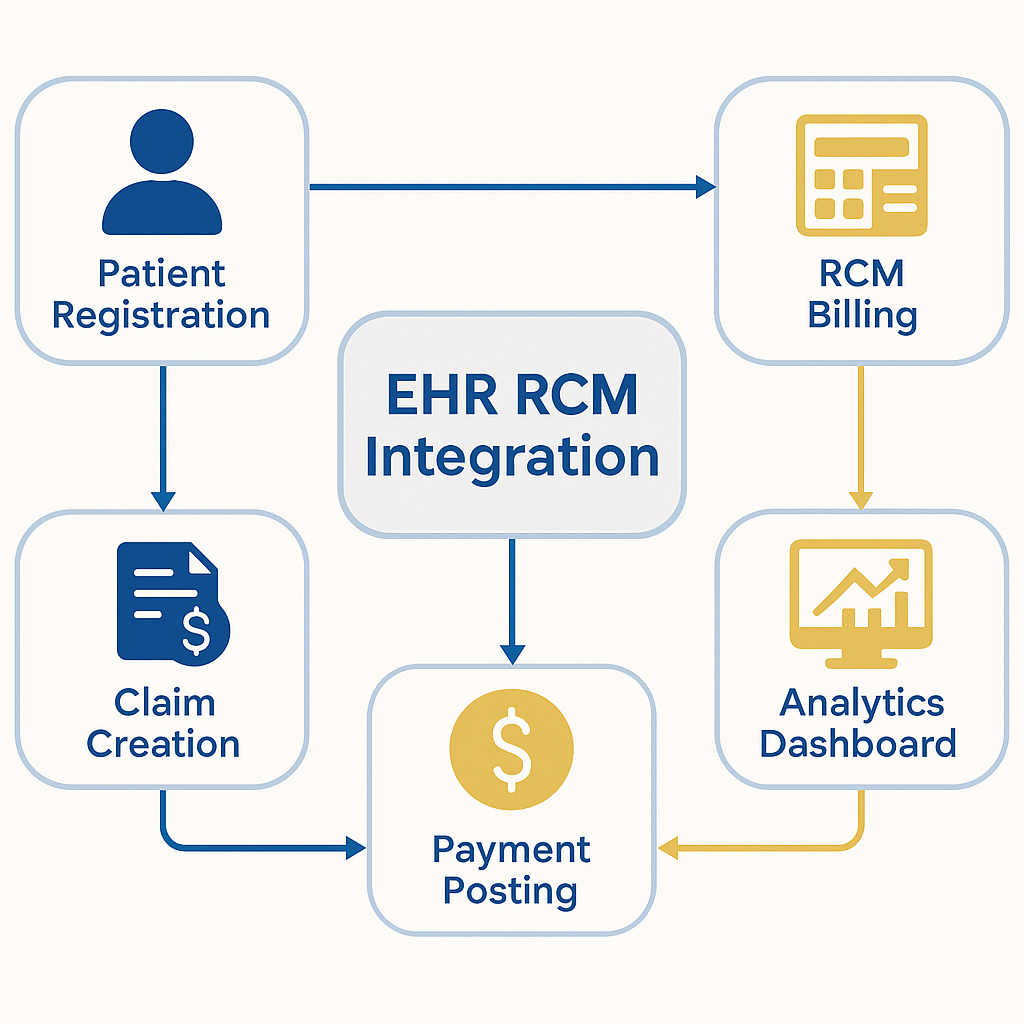

Why Outsourced Medical Billing Services Outperform In-House

Higher Collections Through Denial Management

Outsourced teams track, appeal, and resubmit denied claims — ensuring providers don’t leave money on the table.

Cost Savings Compared to In-House Billing Staff

No salaries, benefits, training costs, or turnover headaches. Outsourcing reduces overhead.

Compliance and Accuracy with Payer-Specific Rules

Outsourced billing companies stay updated on Medicare, Medicaid, and private payer rules, reducing compliance risks.

Scalability as Your Practice Grows

Whether you’re a solo therapist or multi-location clinic, outsourced billing scales with your needs.

How The Ashez Group Protects Providers from Hidden Revenue Loss

At The Ashez Group, we uncover hidden revenue loss and prevent providers from losing money without even knowing it:

- End-to-end medical Billing & Coding

- Denial management & A/R cleanup

- Modifier Accuracy & Compliance checks

- Credentialing & Enrollment Services

- Virtual Front desk & Eligibility Verification

As a SWAM-Certified, Women-Owned Company, we provide expert billing solutions tailored for healthcare providers nationwide.

📈 Your revenue is our priority — and that means going beyond data entry to deliver true billing success.

Conclusion: The Smarter Choice in Provider Billing vs Outsourcing

The debate of Provider Billing vs Outsourcing is clear: outsourcing ensures compliance, better collections, and financial stability.

Doing your own billing may feel cost-effective, but it leads to denied claims, lower reimbursements, and silent revenue loss.

By outsourcing to experts like The Ashez Group, providers secure compliance, improve collections, and protect their financial future.

👉 Don’t keep losing money without realizing it. Contact us today for a free billing analysis.